Summit Content

Summit Themes

The critical investment themes and strategic conversations that define MandateX Summit 2026.

Theme 01

REITs & Income Vehicles

Structuring stabilized real estate into regulated, yield-generating vehicles deployable by institutional and private capital.

Key Discussion Points

- REIT formation and structuring frameworks

- Income vehicle design for institutional allocators

- Regulatory compliance across jurisdictions

- Asset selection and portfolio construction for yield

- Distribution strategies for REIT products

- Governance and performance monitoring

Theme 02

Developer-Led Institutional Real Estate

How developers convert asset pipelines into investable platforms aligned with long-term institutional capital.

Key Discussion Points

- Developer-to-investor alignment structures

- Institutional-grade asset origination

- Capital partnership models and co-investment

- Risk mitigation in development-stage investments

- Pipeline visibility and commitment frameworks

- Exit strategies and liquidity planning

Theme 03

Tokenization & Digital Distribution

Using regulated tokenization to expand global access, transparency, and distribution of real asset investment products.

Key Discussion Points

- Tokenization infrastructure for real assets

- Regulatory frameworks for digital securities

- Distribution platforms and investor access

- Custody and transaction settlement

- Secondary market development

- Integration with traditional fund structures

Theme 04

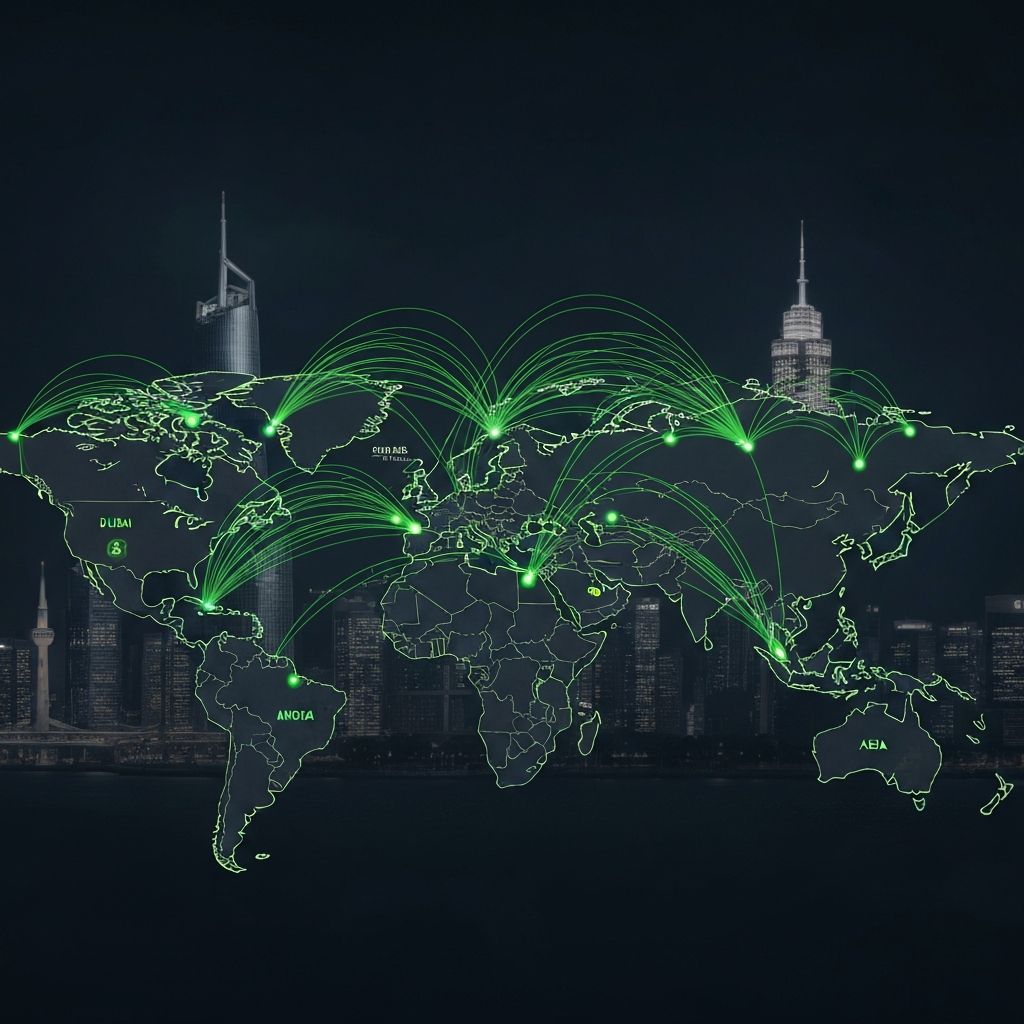

Cross-Border Capital Allocation (Real Assets)

Designing and executing real estate mandates across MENA–Asia corridors through institutional and private banking channels.

Key Discussion Points

- MENA-Asia capital corridor development

- Cross-border investment structuring

- Regulatory and tax considerations

- Currency and political risk management

- Partnership frameworks across jurisdictions

- Capital deployment execution strategies

Theme 05

Mandate Structuring, Governance & Execution

How mandates move from intent to deployment through fund structuring, governance frameworks, compliance, and execution discipline.

Key Discussion Points

- Mandate definition and alignment

- Governance frameworks for real asset funds

- Compliance and regulatory navigation

- Performance measurement and reporting

- LP-GP relationship management

- Execution discipline and deployment tracking